By the end of June, MicroStrategy released its financial statements for quarter two; while the CEO Michael Saylor boasts about his company, there is a different story to see from the data presented today. To understand what financial statements are, you first need to know that there are three main categories: these include the balance sheet, income statement and lastly cash flow. The balance sheet is a snapshot of the businesses assets, liabilities and equities at a single point in time meaning that it’s usually not read as a long term view of a company and is ever changing. The income statement is the summary of a businesses revenues and expenses over a period of time. It uses the accrual method of accounting, meaning that revenues are recorded when they are earned and not received while expenses are recorded when they are incurred and not paid. Lastly is the cash flow which uses the cash method of accounting, meaning anything that the company spends on or receives will instantly be recorded down.

Looking at the company’s balance sheet, the first thing to be noticed is that MicroStrategy’s has lost 1 billion dollars in total assets in just two quarters while total liabilities have gone up 6.5%, meaning they own less and they owe more. Furthermore, the company has a debt to equity ratio of 14.7, this shows for every dollar invested in the company about 93 cents came from debt while 7 cents came from the company’s equity; definitely not a number you want your company to see. Moving on to the income statement, MicroStrategy took a staggering loss of over a billion dollars for the combined two quarters, making a gross profit of 96 million dollars. If this wasn’t bad enough, the free cash flow of MicroStrategy was negative 786 million dollars, this shows that there’s an inability to generate enough cash to support the business itself. If MicroStrategy continues on this path they can soon see more trouble ahead including bankruptcy possibly.

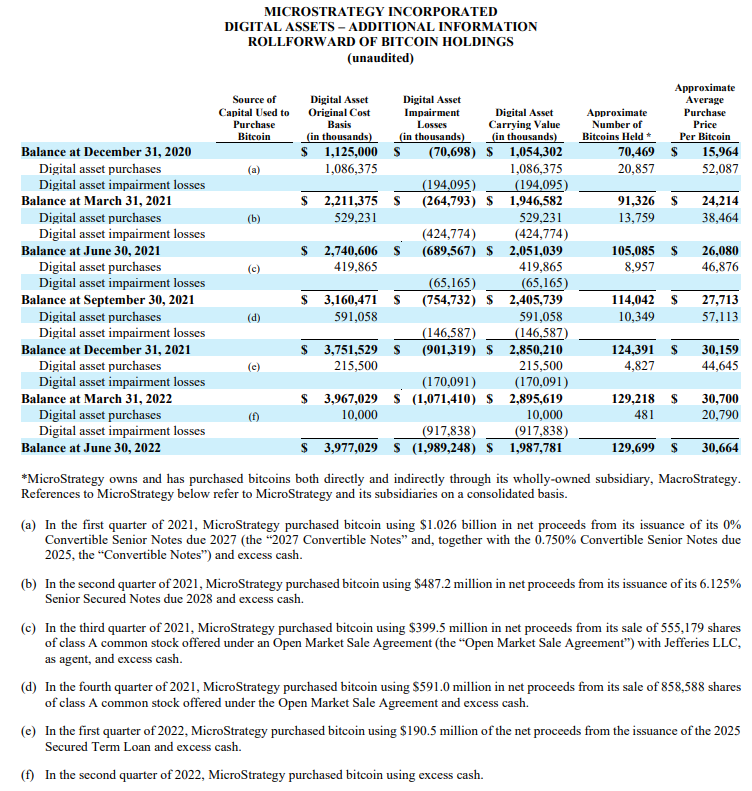

MicroStrategy is known to hold a good portion of crypto, its average purchase price per bitcoin is at 25800. Currently, bitcoin is priced at 18800 and can presumably go lower looking at the economic stance of the world economy. Michael Saylors company holds about 130,000 bitcoins and has taken an impairment loss on these investments of almost two billion dollars. The way they were able to fund their ‘crypto spending’ was either by the profits they got from issuing their stock known as additional paid in capital, or by taking unsecured debt with no collateral being put down. They owe these debts spanning from 2025 to 2028 and if they don’t pay these senior notes off, they could possibly go insolvent.

For more information on what the balance sheet, income statement and cash flow is visit the links below

https://www.investopedia.com/investing/what-is-a-cash-flow-statement/

https://www.investopedia.com/terms/i/incomestatement.asp

https://www.investopedia.com/investing/what-is-a-cash-flow-statement/

Below is MicroStrategy’s financial results