S-1 statements are one of the primary forms to analyze when investing in a new business. When a company plans to go through with an initial public offering (IPO), it must file an S-1 with the Security and Exchange Commission (SEC) and be approved. There are two types of IPOs; traditional IPOs, where investment banks purchase shares from the company that’s getting ready to IPO so that the bank can sell them to wealthy institutional investors. The second of the two is a Special Purpose Acquisition Company (SPAC). Whichever IPO it is, the SEC is required to make the S-1 form public, giving investors a multitude of information available to make informed decisions. The S-1 is like a rulebook to investors from the company’s directors; if you are not aware of all the rules, the company can take advantage of the investor that didn’t read the fine print carefully.

To obtain access to an S-1 statement, investors need to go to the SECs website, which utilizes a tool called EDGAR. When on the page, click company filings and search the company by name or ticker symbol. There may be an assortment of businesses with the same moniker, so select the correct company going public. Next, go to the oldest form created for the company, which in most cases will be the S-1 form. Now, the user will have access to an S-1 form for the desired company.

https://www.sec.gov/Archives/edgar/data/1844840/000104746921001095/a2243226zs-1a.htm#ca11501_summary

The S-1 form covered as an example will be for Artisan Acquisition Corp, a SPAC registered in the Cayman Islands. SPACs work in an intriguing way to go public, the founder of a SPAC raises money like an investment bank by issuing shares to investors. The funds used to purchase shares will go to an escrow account affiliated with a bank to keep assets safe. Monetary funds can also go into company liabilities, such as traveling to other parts of the world to look for an organization to acquire or advertise the SPAC through a business roadshow. SPACs have become a very prominent option anew, with more than half of IPOs utilizing them today. Directors value the need for a cheaper and more private version of an IPO, which fuels its popularity.

There is generally a good deal of information inside an S-1 statement. This article will give an overview of the most important sections to view.

The Summary

The material in the summary of the S-1 is typically recycled throughout the prospectus. Therefore, it’s essential to view this section so the investor can traverse through the rest of the prospectus in a less cumbersome manner. The information that’ll be available in this section will include how many shares the company will release and the class of shares. In addition to how many directors are in charge of the IPO and who the directors are. More about the board of directors can be viewed in the Management section of the S-1. Traditional IPOs will give more information about the company going public. However, due to the nature of a SPAC being a more private investment vehicle, the information will be limited regarding the company they’re acquiring and what the company even does.

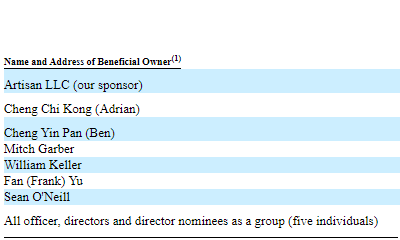

In the case of Artisan Acquisition Corp, key board members include Dr. Cheng Chi Kong (Adrian), vice chairman of New World Development and executive director at Chow Tai Fook Jewellery Group Limited. These companies are all owned by Adrian’s dad and are one of the biggest conglomerate companies in Hong Kong. Other board members include Mr. Cheng Yin Pan (Ben), who works at a venture capital fund with Adrian called C Venture, and Mr. Mitch Garber, C.M., a board member of the NHL team, The Krakens. There will also be 30 million public shares worth $10 each (marked as Class A shares) and 9 million founder shares (Class B). The SPAC was incorporated on February 2nd, 2021.

Risk Factors

If investors were to look at any one section it would be this one. This section will explain the risks that investors will take on if they were to invest in the company. If it’s a SPAC, it’ll tell you the risk of what would happen if there is a failure to acquire a company, and the implications it’ll cause to the investors money. If it’s a traditional IPO it’ll tell the risk of the company getting delisted off an exchange as an example. There can be hundreds of risk factors in an S-1 with some having very important causes and effects.

An example of some risk factors in Artisan Acquisition Corp is no voting rights and fewer rights to protect the investor with Cayman Island laws. More risk factors include if desisted on the Nasdaq, the shares will be able to be bought in an over-the-counter (OTC) market, and Artisan may issue more Class A shares which can potentially dilute the stock price.

Use Of Proceeds

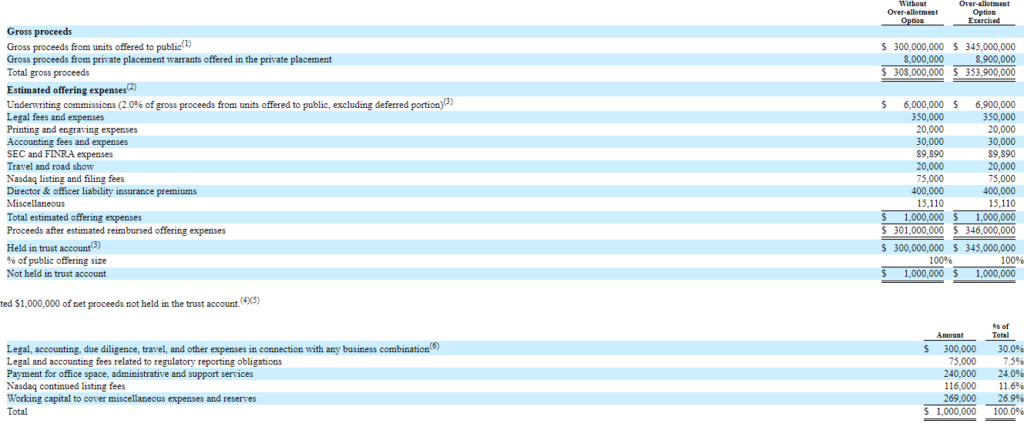

This portion of the prospectus explains how investor-given funds will help to improve the IPO. The Use Of Proceeds section predicts the payment structure that a company is obligated to pay off.

Artisan lists their proceeds in two tables, the 300 million dollars from offering shares to the public plus 8 million dollars of warrants (typically more expensive than shares) and the over-allotment, meaning additional shares added to the stock. In addition, they’ll need to pay off expenses such as 6 million dollars to underwriters (being banks in most cases) and other liabilities such as tax, travel, or exchange listing.

Dividend Policy

Dividends are rewards given to investors quarterly or annually who hold stock. The decision for a company to offer dividends is discussed with the board of directors. If the directors agree to pay out dividends, the prospectus will mention the amount to be paid in full to its shareholders.

In the case of Artisan Acquisition Corp, they do not plan on paying dividends to their shareholders.

Management Discussion and Analysis

Investors or analysts can consider this together with financial statements and risk factors. The management section in an S-1 is vital to read because directors will discuss the points they think are significant. An important thing to note is that companies may put valuable information about acts they must follow with investors’ money.

Artisans summarizes some points made in the risk section and add additional points regarding acts they must follow, like the Sarbanes-Oxley Act, and how the current business model is an emerging growth company.

Proposed Business

This section is meant to paint the business in a good light and advertise why the current structure of directors will lead to success. Although the Proposed business segment will cover most of what’s in summary, it may add additional business strategies that the company will try to incorporate.

These are some points Artisan uses to promote their SPAC:

•Experience in sourcing deals globally through their strong proprietary network both in Greater China and across the world.

•Unparalleled access to strategic global resources.

•A well-established track record of sourcing.

•Access to capital, including capital sources across various business cycles in both Greater China and globally.

Certain Relationships And Related Party Transaction, Principle Shareholders, Description Of Securities

The last three important sections are similar to each other. The principal shareholders’ section will inform the investor on how many shares each director in the company owns and how many shares the sponsor gets if the IPO is a SPAC. The description of securities will go into further detail about shares of the company that’s covered in the introduction; this section will eliminate any confusion. Lastly, the relationship segment will cover any financial deals between the company and any other related party; in a SPAC, it would be the sponsor.

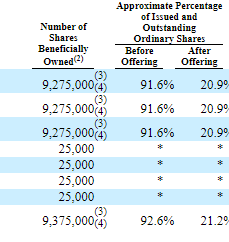

In the case of Artisan, the structure would look like the image above, under the Principle Shareholders section.

How Manipulation Occurs

Both traditional IPOs and SPACs have flaws that companies are able to take advantage of, this can lead to bending the rules in order to cut costs or have greater freedom in terms of business activities. SPACs are known to be more troublesome with the SEC because of the privacy given to the company being acquired. SPACs can find a company that’s worth 80% of the proceeds investors put in, meaning that investors will not be refunded because the SPAC found a company; even it it’s worth less than what investors paid for. Secondly, SPAC sponsors are also allowed to typically get 20% of the common stock for hosting, which they can immediately sell off, plummeting the stock price and leaving investors at a loss.

Congress passed the Sarbanes-Oxley Act (SOX) in 2002 after the Enron debacle that initiated one of the largest corporate failures in history. The SOX act made it so companies have to report their internal controls to ensure there’s no fraud in the financial reporting process. Not only does a company need to report on its internal controls, but an auditing firm like the big four needs to do separate internal controls on a company. Auditors must also rotate every five years, creating fewer manipulation opportunities for businesses. These measures were implemented to make it safer for everyday investors.

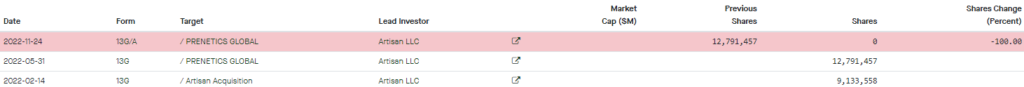

Artisan Acquisition Corp. was able to take advantage of the SOX act by registering as an emerging growth company. Emerging growth companies are smaller companies that qualify if they make less than a billion dollars in revenue, are not five years old, and have a public float (shares outstanding) worth less than 700 million dollars. Artisan used its status as an emerging growth company to not have to do internal audits by auditors so that the company could be under less scrutiny by the SEC and auditing firms. This means there can be potential for financial statement tampering because auditors are not allowed to check the company’s internals. Furthermore, Artisan can withdraw from reporting its own internal audits with the SEC until December 31, 2022. Coincidently, Artisan sold all its company shares on November 24, 2022, about half a year after taking Prenetics Global public with its SPAC.

Artisan also took advantage of Rule 419 of SPAC transactions. Rule 419 states that investors’ funds must be kept in an escrow account while a SPAC is searching for a company to acquire and that the sponsor cannot invest those funds. Artisan uses Rule 3a51-1, which asserts that if the company has tangible assets in excess of five million dollars, it can cancel out rule 419—giving Artisan the ability to invest shareholders’ money and take out the interest owned from the proceedings.