How To Calculate Discounted Cash Flows

Learn how to price a company and find the fair value of its stock price using the DCF method

Each case study below will present a Financial Statement for the following company. Each important section in the statement will express an overview on the current investments, assets, liabilities ect. that the the company currently has. Risks and the positive factors of a company are important to look at when investing in a certain company or security as well as how it’s doing during an economic downtrend or uptrend (to see if there needs to be changes in order for a company to survive). This information is presented with facts to help educate you on whether a specific company should be viewed as a potentially good investment or if a company should be stayed away from. After all, these financial statements are the language to a business and understanding them is crucial if you want to make a good decision and not a guess. Looking at just a stock ticker and judging the company on its current price is not enough to see how the company is really doing in terms of long term revenue, expenses and cash flow generated.

Learn how to price a company and find the fair value of its stock price using the DCF method

PepsiCo’s free cash flow was down 13% in 2018 year to year, and is still in a downward spiral.

S-1 statements are one of the primary forms to analyze when investing in a new business. When a company plans

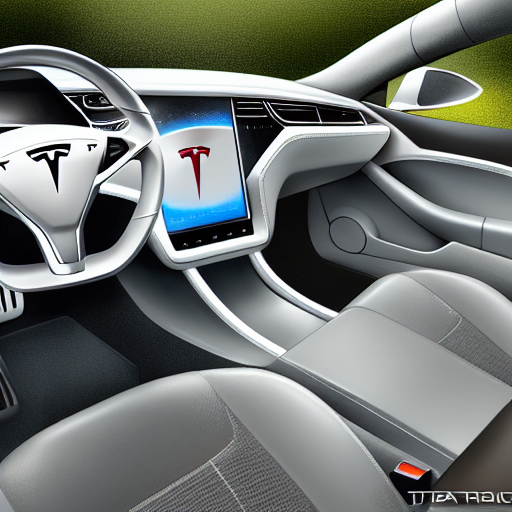

Tesla continues to break records in revenue but is the overall price of the stock an issue to investors?