What is a DCF?

DCF stands for discounted cash flow. It is a intrinsic valuation method used to estimate the value of an asset based on its future cash flows. It is helpful when trying to determine the future value of a company based on internal factors.

5 steps to building a DCF:

⦁ Forecast the Free Cash Flow

⦁ Calculate the Weighted Average Cost of Capital

⦁ Calculate the Terminal Value

⦁ Discount the Free Cash Flow and Terminal Value

⦁ Calculate the implied share price

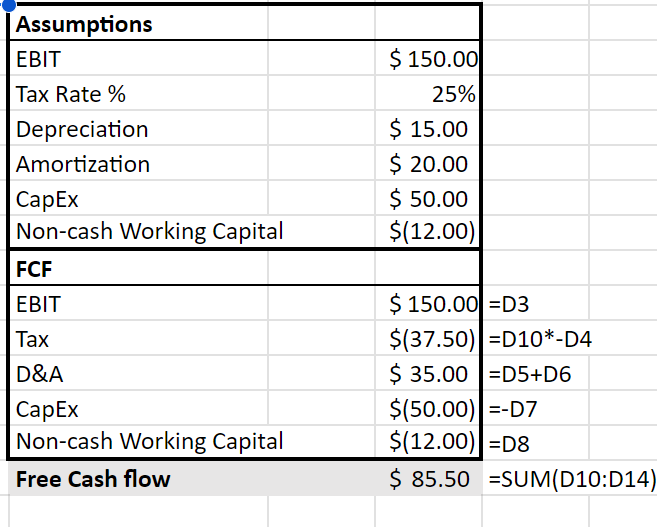

Free Cash Flow Formula:

FCF = EBIT*(1-tax rate)

+ (Depreciation and Amortization)

– (Capital Expenditures)

– (Increase in non-cash working capital)

Example:

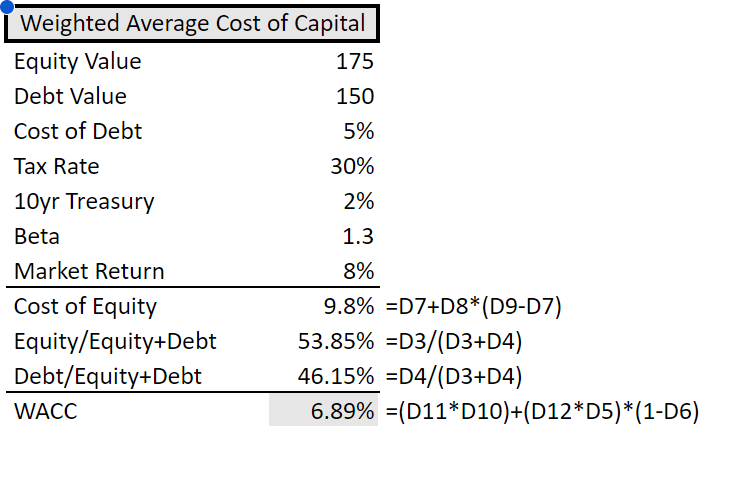

Weighted Average Cost of Capital Formula

The weighted average cost of capital or WACC calculates the cost of deploying capital. It is the average rate that a company expects to pay to finance its assets. This is based on their cost of debt, equity, and the current tax rate.

E = Equity

D = Debt

T = Tax Rate

RE = Cost of Equity (CAPM)

RD = Cost of Debt

Example:

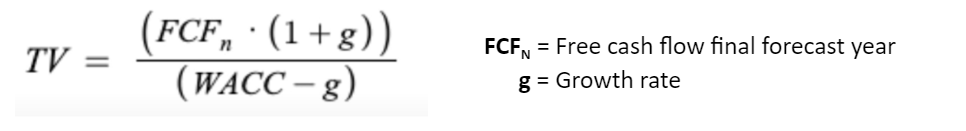

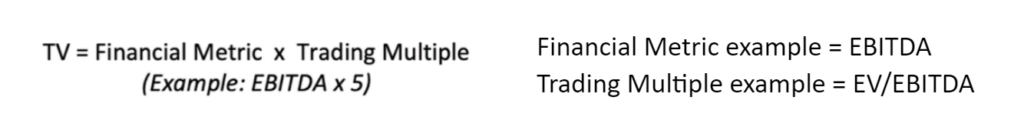

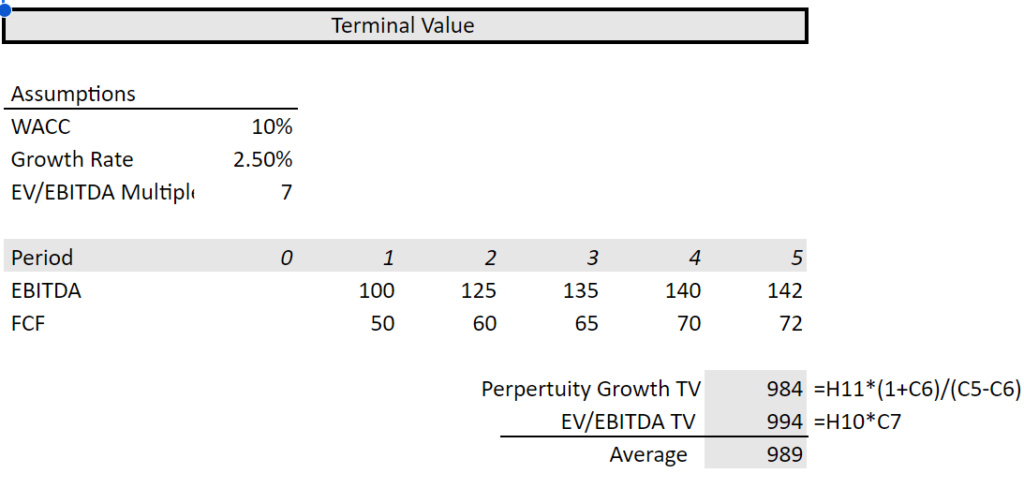

Terminal Value

Terminal value is the predicted value of an investment beyond its estimated cash flow period. This can be calculated using the perpetuity growth method or the exit multiple method.

Perpetuity Growth Method assumes that the cash flows will grow at a constant rate forever.

Exit Multiple Method assumes that the company sold using a multiple metric in this case enterprise value divided by earnings before income tax depreciation and amortization.

Example:

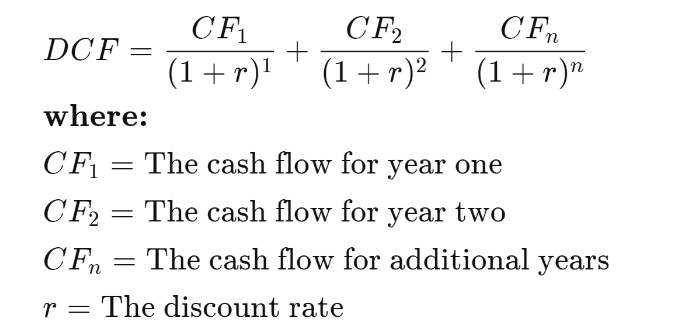

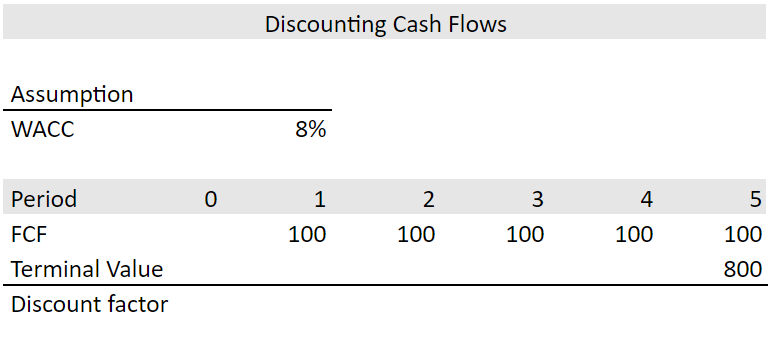

Discounting Cash Flows

This is done by taking the free cash flow for each year, dividing it by one plus the discount rate raised to the power of each period and then summing all discounted cash flows together to get the present value of future cash flows. Then by adding it to the terminal value you get the current enterprise value.

To simplify, to find the current value of an investment one must add up all of the future cash flows generated by the venture discounted by an average rate of cost of capital and then add a predicted future value which goes beyond the cash flow period based on perpetual growth.

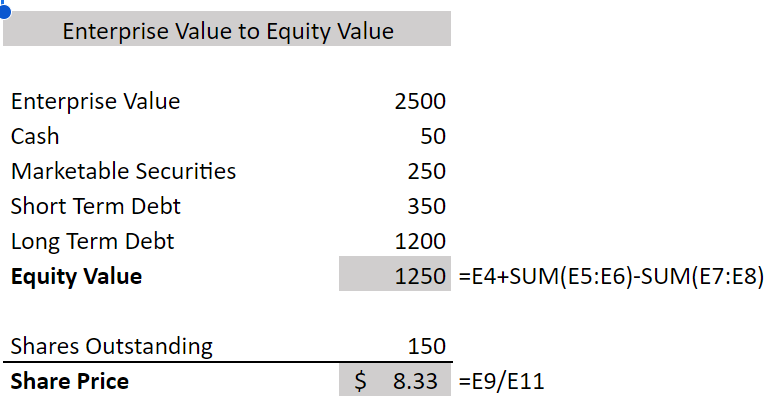

Enterprise Value to Equity Value

Once enterprise value is calculated we can determine the equity value based on the DCF analysis. This is done by subtracting debt from the enterprise value and then adding cash. This can be further broken down into equity value being equal to enterprise value minus debt and debt equivalents minus non-controlling interest minus preferred stock plus cash and cash equivalents. But in the most basic terms we are simply subtracting debt and adding cash and liquid assets.

By dividing equity value by the shares outstanding we are able to determine the share price